Last Updated on: 24th May 2024, 09:36 pm

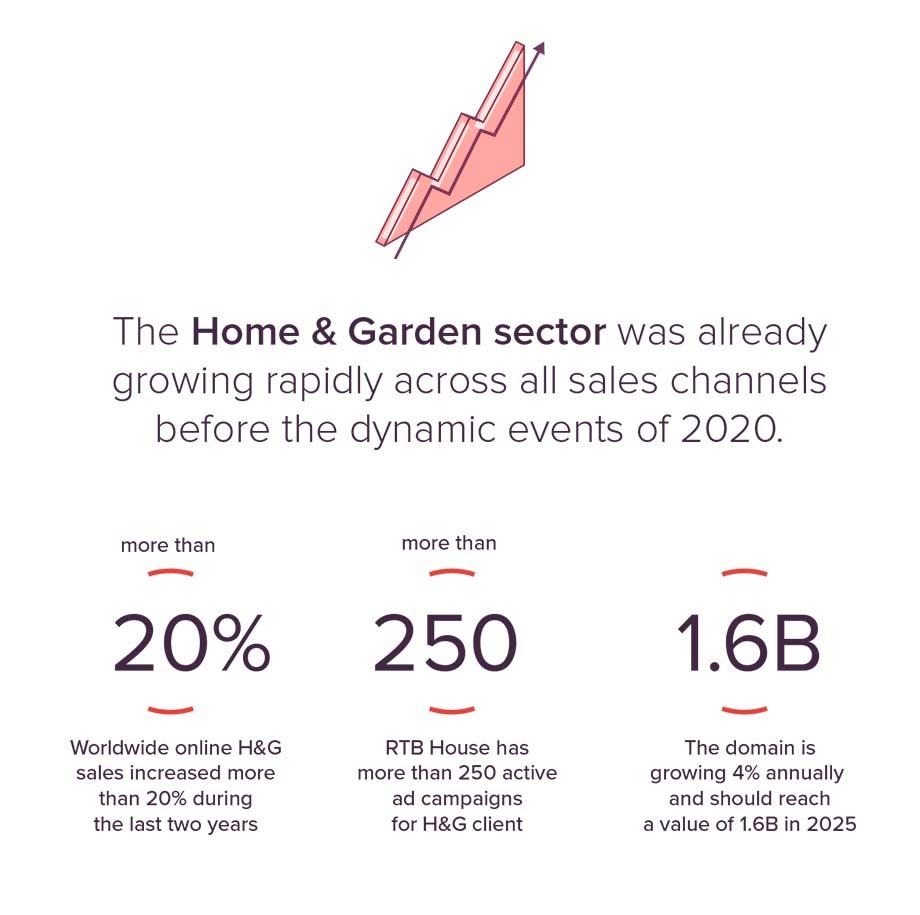

A recent Harvard survey points to an expected 8.6% rise in home renovation and maintenance spending throughout 2022. Such a rise in a single year would usually be unheard of, but it is actually part of an ongoing trend in the home and garden domain. According to Statista, there has been a 20% growth in the H&G market in the last two years and it will be worth 1.6B USD globally by 2025.

In this article:

- We’re going to share some really interesting home and garden trends and stats about how the pandemic has increased people’s focus on the comfort and beauty of their households

- We’re then going to look at 3 buyer personas that have emerged in the last 2 years and how they will shape the future of advertising

Table of Contents:

- 6 significant home improvement stats

- Changes and challenges for H&G stores

- The new Home & Garden buyer personas

- Home comfort for your ad campaigns

6 significant home improvement stats

- Gardening has gone wild. Outdoor landscaping projects were the most common type of home improvement project done in the US in 2020.

- Inside is what matters most. Though people are gardening, they are not focused on exterior home improvements. Residential cleaning saw a 70% increase in web results while outdoor renovation generated only 10% of online search growth.

- Beautiful and functional things. The world furniture market is set to grow 4% in 2022 as people continue to seek home comfort.

- Spaces for relaxation take priority. The bedroom and living room were the most-renovated rooms in 2020. Sales in both categories increased by more than 35% compared to 2019.

- Time on our hands. According to Statista, the pandemic has been a driving force for home improvements. In the US, 25% of people said they completed projects because they finally had time for it, 21% wanted to add value to their home, and the same number said they were looking to make it cozier while 16% stated that they were looking to adjust their home to life under COVID.

- A global trend…for old and young. We’ve taken a number of stats from the US, but the growth of H&G really is a global phenomenon and is not limited to one buyer group. For example, in France, 39% of young people aged 18 to 24 carried out some kind of home improvement project during the 2020 lockdown.

Changes and challenges for H&G stores

Whether it is a furnishing giant like IKEA, a DIY and home superstore like OBI, or a fast-moving challenger such as Home24, the pandemic has had a massive influence on both the volume of sales and the type of buyers.

Megastores like IKEA and OBI have traditionally thrived on in-store shoppers and hands-on experiences. Now, they have had to rapidly scale their existing home delivery channels and accelerate the development of online sales, embracing the future of advertising – no small feat with thousands of products in their range!

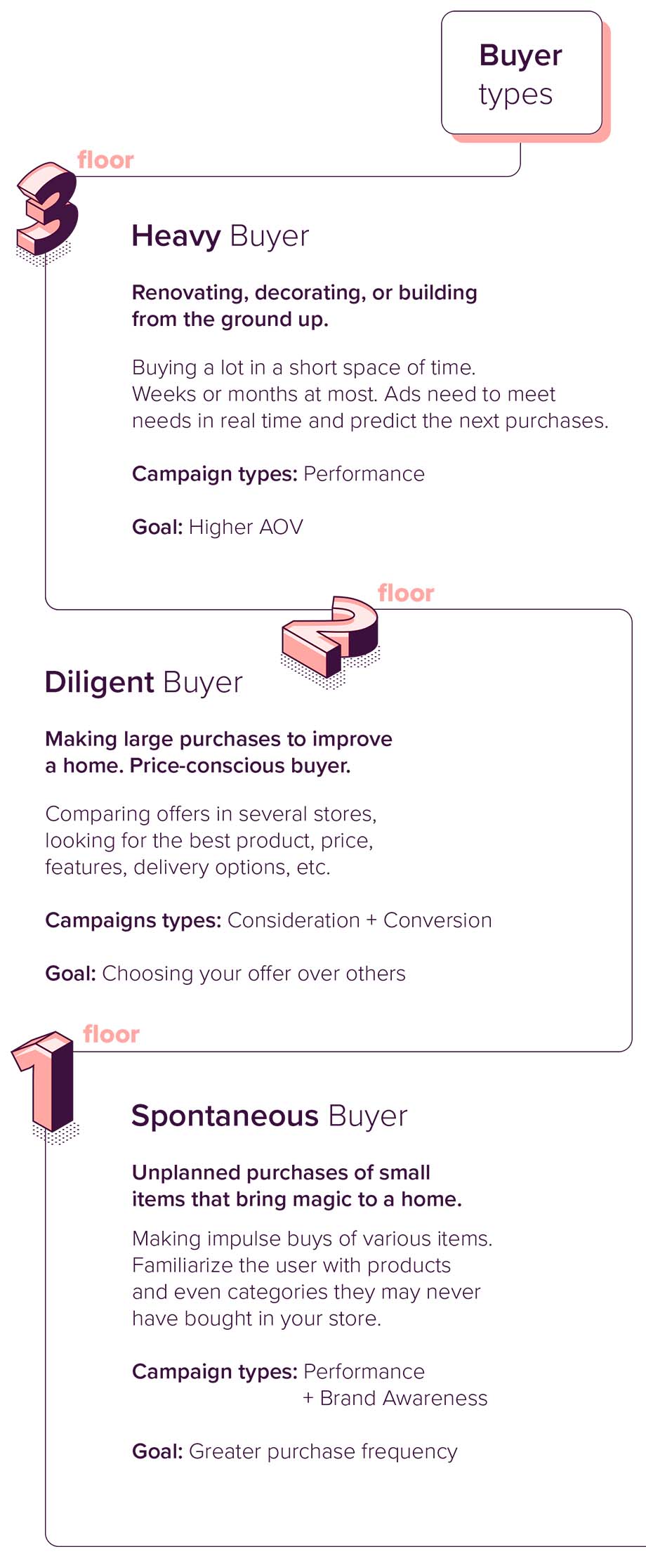

The other challenge has been keeping up with changing buyer types as new customer behaviors have emerged. We’ve identified three buyer types that Home & Garden stores need to cater for, which you can view in full in this infographic.

The new Home & Garden buyer personas

The Heavy Buyer

Building from the ground up or undertaking major home improvement work. The Heavy Buyer is someone who is building their dreams and will be making dozens of large purchases over a short space of time. The aim is to make your store their go-to supplier for their project. Use performance campaigns to increase average order volumes. Intelligent campaigns can also predict the phase of the project and offer what the user will need next as the Heavy Buyer moves from tools and hard building materials through decoration supplies and onto soft furnishing. Help them with their dream project from start to finish.

The Diligent Buyer

The Diligent Buyer is tech-savvy, price-conscious, and takes time to get it right. In a time of limited household budgets, it makes sense to shop around—especially when online shopping offers a greater choice of where to purchase, as well as a range of prices and added extras. If you have great products, you can use performance campaigns to also win out in a competitive market by highlighting factors like home delivery, installation, returns policy, and discount pricing. The Diligent Buyer cares about the details, so make sure you give them information, not just inspiration

The Spontaneous Buyer

Spontaneous Buyers want to add comfort and personal touches to the living space one small purchase at a time. They are often drawn to things they see online and decide to add a beautiful cushion to their sofa set or buy a smart new door handle. These small purchases add up over time and loyal Spontaneous Buyers can be the lifeblood of your business. Use video ads, branding content, and product recommendations in performance ads to show them a curated set of products that might pique their interest. Increase purchase frequency, even if the average order volumes stay low.

Home comfort for your ad campaigns

If you want more info on the new personas that have emerged and how to target them more effectively with online performance or branding campaigns powered by Deep Learning, please do not hesitate to contact us – we would love to help you.